Investment Overview:

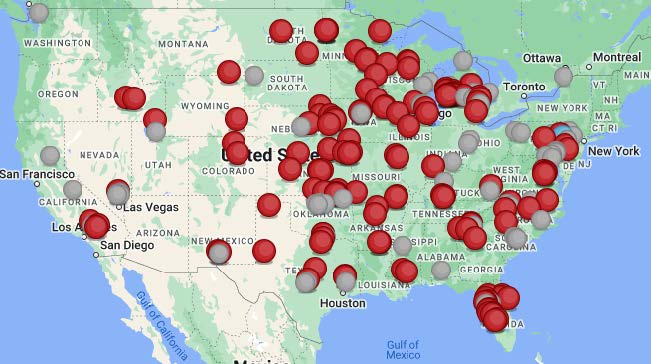

The Real Asset Investor has partnered with Olympus Pines to build Tommy’s Express modern car washes in various high-growth markets across the United States. These markets and locations have been chosen with strategic advice from Tommy’s leadership as areas to outperform the national average due to favorable demographics and lack of substantive competition. The sites will be managed by a team of professionals dedicated to flawless operational execution and customer service.

Tommy’s is a rapidly growing national brand and has been a leading provider of car wash solutions for over 50 years. They are one of the nation’s fastest growing franchises that is leveraging their experience as one of the top car wash equipment manufacturers in the U.S. to transition into offering a cutting-edge car wash experience for customers across the country. Their fully automatic washes feature advances including the easy-loading car wash dual belt conveyor, wide services and free high-power self-serve vacuums on site.

Financial Highlights

Economics

Building + Land: $7-9M

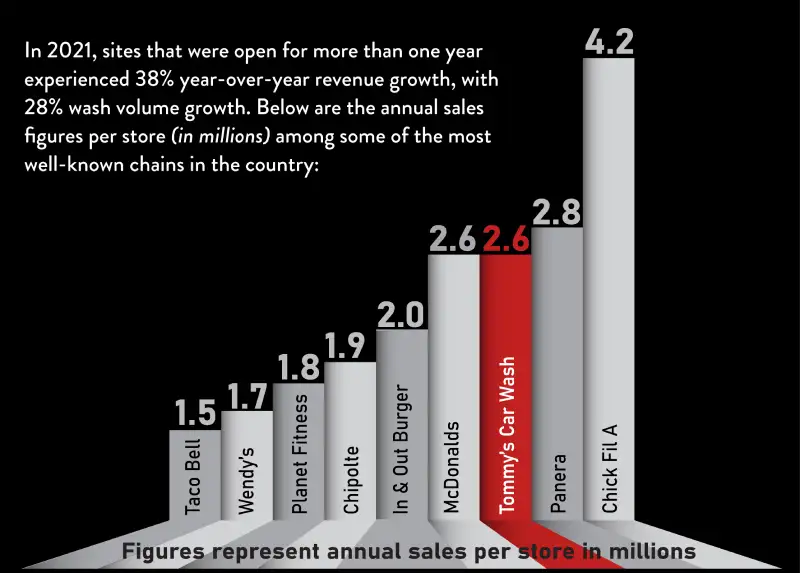

Revenue: $2.6M

Operating Expenses: $1.4M

EBITDA: $1.2M

EBITDA Margin: 45%

Portfolio Locations

Virginia

Maryland

North Carolina

South Carolina

Nebraska

Pennsylvania

Texas

Utah

Company Profile

With over 50 years of industry expertise, Tommy’s differentiates themselves from the competition by focusing on innovation and operational efficiency. Tommy’s leverages technology to enhance the customer experience by using license plate readers for subscription members which identifies customer accounts and their associated wash plan without the need to stop and interact with employees. This reduces the time it takes customers to get through the wash and allows for greater wash volume. In the Fund, the most common tunnel size is 110 feet which can wash 160-180 cars per hour.

On the back end, Tommy’s utilizes technology to monitor the health of the equipment and detergent levels throughout the wash to proactively complete maintenance and stay ahead of any forthcoming issues. Each piece of equipment on the wash line also has backup to take over in the event a part fails. Additionally, staff is trained on how to quickly fix and/or replace equipment. These preventive measures ensure minimal downtime in the event of malfunction.

See below for how Tommy’s business model and strategy allows them to outshine their competitors:

Innovation

App-based membership, license plate recognition, proprietary point of purchase, detergent management system, real-time business analytics, and much more.

Expertise

Proven business and operations models built on over 50 years of car wash operation experience helps you be more efficient, increase your ROI, and have a great guest experience.

Unique Building Design

Instantly identifiable architecture, natural light inside, and a site layout built to maximize your throughput. Our design also offers multi-lane, unlimited club app lanes and cashier lanes that help increase revenue and improve your ROI.

Low Labor Mode

A Tommy’s Express location is built to run with only 12 full time team members on the payroll.

Installation

Our experienced teams will help get your wash up, open, and fine-tuned for the best possible guest experience.

Industry-Leading Equipment

Tommy’s Express washes are built with dual belt conveyors, stainless steel wash equipment, robust drying systems, and state-of-the art wash control systems.

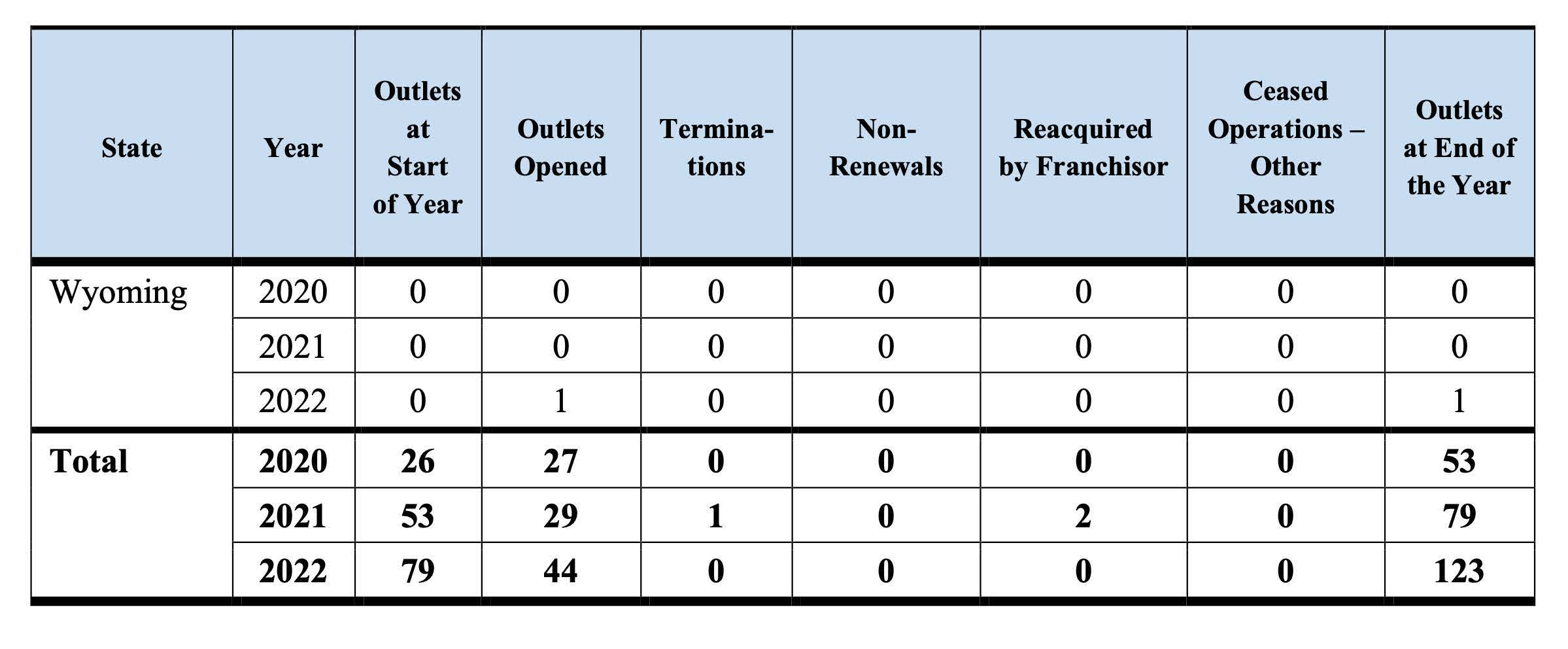

From 2015 to Year End 2023, Tommy’s has grown from 5 car washes to 184. By the end of 2024, it is anticipated that there will be more than 270 Tommy’s Express locations across the country. While the growth is rapid, Tommy’s high standards have maintained the same. All sites are reviewed through a robust evaluation process. There are multiple indicators that predict success, three non-negotiable thresholds for success include the following:

- Within 500 feet of regional or national retail brand name

- Multiple points of entry, corner, connected to corner, or any cross access

- Free of significant competition (within a half mile)

Tommy’s success is built on innovation and operations

Innovation

The Tommy’s App

Conveyor belt

Industrial design

Operations

On-call staff

Remote monitoring

Tommy University

Partnership

Best practice sharing

Regional distributor support

Marketing

Coordinated marketing campaigns

Centralized management

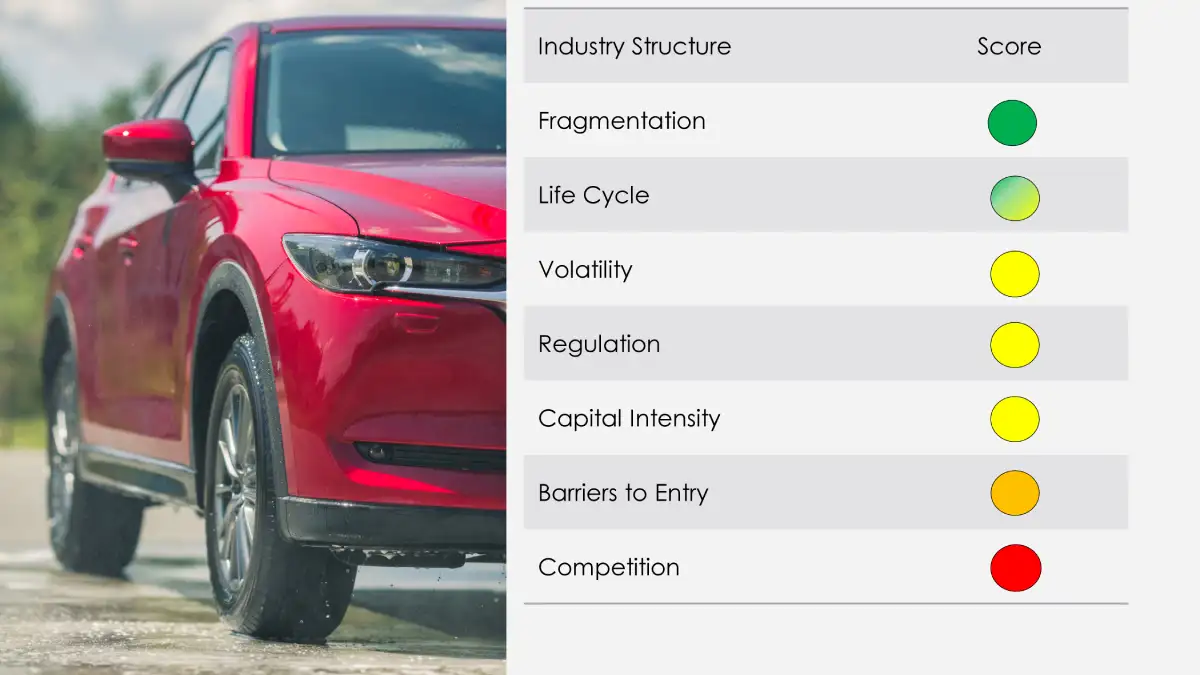

Industry Overview

The car wash industry is highly fragmented and growing rapidly.

The industry’s revenue totals over $10.3 billion and has an estimated 5-year compounded annual growth rate of 4.6%. While more than 61,000 car washes make up the industry, no one player generates more than 5% of the industry’s revenue.

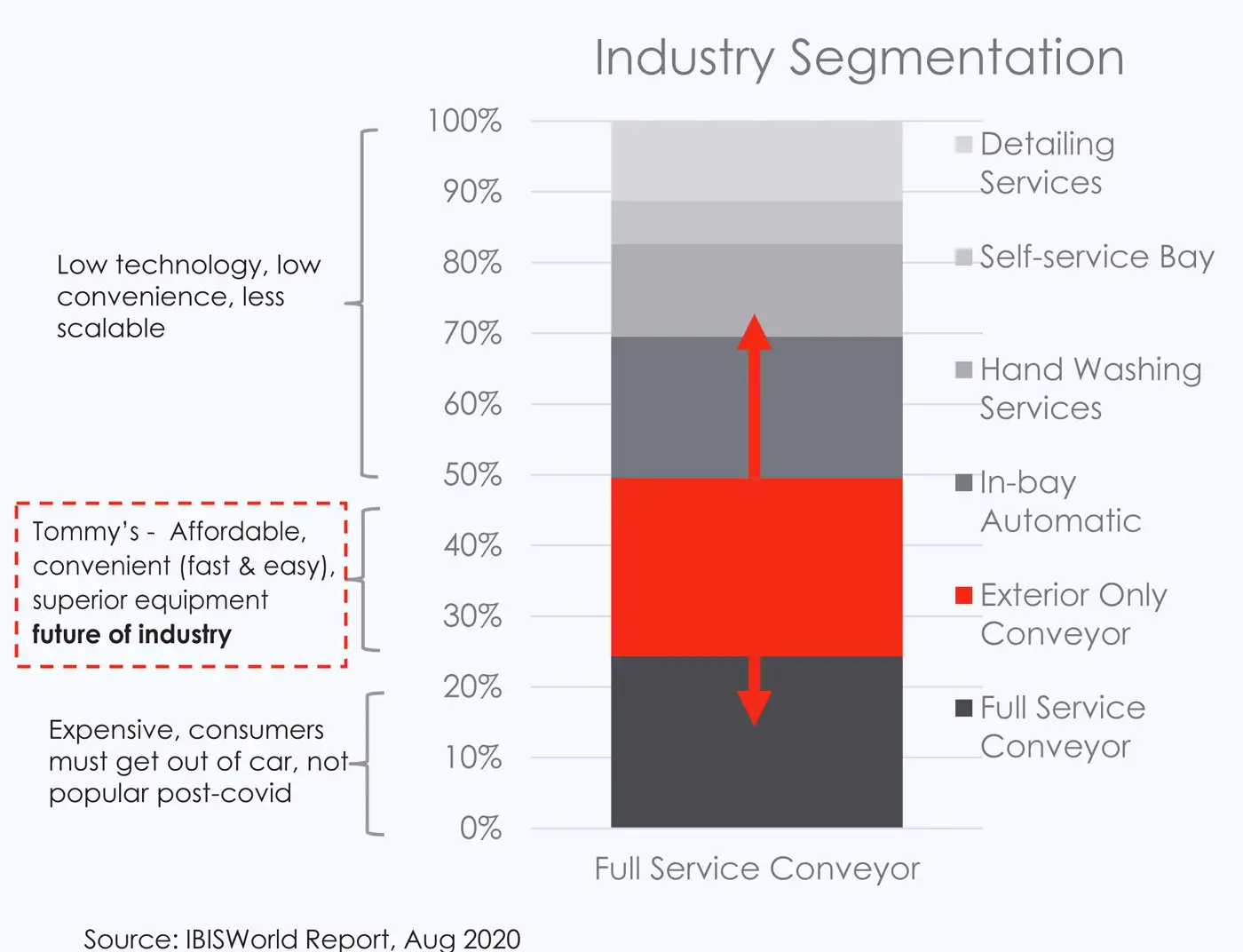

Industry lacks innovation and is ripe for disruption

When assessing the variety of offerings for car washes in the industry today, most are overpriced, provide inconsistent service/washes, and are largely unreliable and inconvenient. Tommy’s is addressing a segment of the market that is growing organically while also disrupting the existing industry.

The objective is to drive value through

1) Implementing cutting-edge technology,

2) Creating recurring revenue through subscriptions and partnerships

3) Prioritize customer service

Tommy’s is a leader in minimizing environmental impact

WATER CONSERVATION AND RECLAMATION

- The Tommy’s system uses a water reclamation system with Rotating Bed Biofilm Reactor (RBBR) technology to reduce consumption without compromising on quality

- Up to 90% of water can be reclaimed (40% more than industry standard)

- Highly efficient targeted wash equipment

- Tommy’s Express uses ¼ the water as at-home washing, and sends water and detergents to the sewage system to be treated versus runoff into the environment

LEED CERTIFIED BUILDINGS

- Utilizes efficient design, natural lighting, and other energy conserving features

PARTNERSHIP WITH WATER MISSION

- Tommy’s Express has partnered with Water Mission, a nonprofit organization advancing sustainable clean water solutions in developing countries and disaster areas

Case Study

Our partners, Olympus Pines, have continued to display their strong operational capabilities through a variety of strategic decisions which have resulted in membership and revenue growth since Day 1. At every car wash in the fund, we will implement a marketing, sales, strategic partnership initiative and employee incentive plan that is unique to any other operator. Our first development site that is now in operations broke Tommy's opening weekend membership record at 1,191. The previous record was 1,152.

Frequently Asked Questions - Tommy’s Carwash Fund

OPERATIONAL:

This is an equity fund focusing on the development of Tommy's Express Car Washes in high growth markets. Our strategy is to grow our portfolio of Tommy’s Express Car Washes to roll up and sell to a large institution in the coming years as there is high demand for large portfolios of express car washes by private equity institutions. This is not intended as a long-term hold investment, but rather build and sell.

There will be 5-6 car washes in the fund, however, we are on track to build a portfolio of 100+ car washes in which investors will benefit from the exit multiple of the entire portfolio. (The scale of the entire portfolio historically drives up the sales price of all car washes vs. selling as single site or a small portfolio).

In recent years, the car wash industry has changed significantly with the introduction of the subscription model, advancement and implementation of technology and improved operational efficiencies; all of which has led to operating margins that are difficult to match in other industries.

Click Here to read the Wall Street Journal Article “Private

Equity Wants to Wash Your Car”

Yes. We have been partnered with our operating partner since 2021 who is currently operating our existing portfolio of Tommy's Express Car Washes. Our Operating Partner is one of the fastest growing car wash operators in the country and are currently the second largest Tommy’s Express Franchisee. (See what they did to an already Top 5 performing Tommy’s Express Car Wash in the U.S. on page 10 of the investment summary!)

Click Here to read about Tommy’s Express Ranking #1 as the Smartest-Growing Brands in the U.S.

RETURN/STRUCTURE/TAX:

Investor returns are derived from both the net operating cash flow of the car washes in the Fund as well as the equity appreciation realized upon exit (which we anticipate being the majority of the overall return on investment).

As with all real estate, location is key. We work closely with the team at Tommy’s Headquarters to help select attractive, high growth markets to grow our portfolio. We then focus on Class A locations within those markets. While Tommy’s Express business model has already proven to be successful, we maximize risk mitigation and focus on locations with the highest probability to succeed (see details on site evaluation process on page 7 of the investment summary). Additionally, all sites in the fund have already been selected and we do not accept investor funds unless that is the case.

Yes. The car washes in the fund are eligible for aggressive depreciation benefits. These benefits will be realized once the locations are operational and will be passed to investors. Note that this is a development fund, and we expect it to take 12-24 months for each site to become operational. Due to the constant changes in the tax code, we have not provided depreciation estimates, however, based on prior experience, we have realized losses of more than 75% of invested capital within the first year a site is operational.

Yes, it is possible for the term to be less than five years. We intend to sell the portfolio in the short term.

Since this is a development fund, we anticipate the first distribution to be paid approximately 24 months after funding the investment. Distributions are scheduled to be sent quarterly (30-45 days after quarter end). Note that the sites have already been identified so the lag time could be shorter.

Distributions from net cash flow are treated as passive income and proceeds from an exit are treated as capital gains.

Yes, we have many investors who participate in our offerings using qualified funds.

The minimum investment is $100,000.

If you have any additional questions, please reach out to us at

[email protected].

Franchisees love Tommy’s. Here’s what they told us:

“They perform exactly the way we were told they would”

“Go build a dozen and have a ball”

- Mark Mitchell, Florida

“We were up and running in 18 months.

2,000 members signed up in the first month”

- David Shaner, Nebraska

“[The secret to success was] do exactly what they tell

you to do”

- Jordan Williams, Louisiana

“I have no concern about Tommy’s. Alex has improved

the business a lot”

“We opened and it only took 2 months to cash flow”

- Ray Anderson, Nebraska

“Don’t go cheap on the land. Pay double if you have to”

- Scott Findlay, Tennessee

“I hired my general manager from Dominos”

- Mike Luders, California

Disclaimer

This Business Plan contains privileged and confidential information and unauthorized use of this information in any manner is strictly prohibited. If you are not the intended recipient, please notify the sender immediately. This Business Plan is for informational purposes and not intended to be a general solicitation or a securities offering of any kind. The information contained herein is from sources believed to be reliable, however no representation by Sponsor(s), either expressed or implied, is made as to the accuracy of any information on this property and all investors should conduct their own research to determine the accuracy of any statements made. An investment in this offering will be a speculative investment and subject to significant risks and therefore investors are encouraged to consult with their personal legal and tax advisors. Neither the Sponsor(s), nor their representatives, officers, employees, affiliates, sub-contractor or vendors provide tax, legal or investment advice. Nothing in this document is intended to be or should be construed as such advice.

The SEC has not passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials. However, prior to making any decision to contribute capital, all investors must review and execute the Private Placement Memorandum and related offering documents. The securities are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell their securities Potential investors and other readers are also cautioned that these forward-looking statements are predictions only based on current information, assumptions and expectations that are inherently subject to risks and uncertainties that could cause future events or results to differ materially from those set forth or implied by such forward looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, such as "may," "will," "seek," "should," "expect," "anticipate," "project, "estimate," "intend," "continue," or "believe" or the negatives thereof or other variations thereon or comparable terminology. These forward- looking statements are only made as of the date of this executive summary and Sponsors undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

Financial Disclaimer

This Business Plan further contains several future financial projections and forecasts. These estimated projections are based on numerous assumptions and hypothetical scenarios and Sponsor(s) explicitly makes no representation or warranty of any kind with respect to any financial projection or forecast delivered in connection with the Offering or any of the assumptions underlying them. This Business plan further contains performance data that represents past performances. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data presented.

All return examples provided are based on assumptions and expectations in light of currently available information, industry trends and comparisons to competitor's financials. Therefore, actual performance may, and most likely will, substantially differ from these projections and no guarantee is presented or implied as to the accuracy of specific forecasts, projections or predictive statements contained in this Business Plan. The Sponsor further makes no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown in the pro-formas or other financial projections.