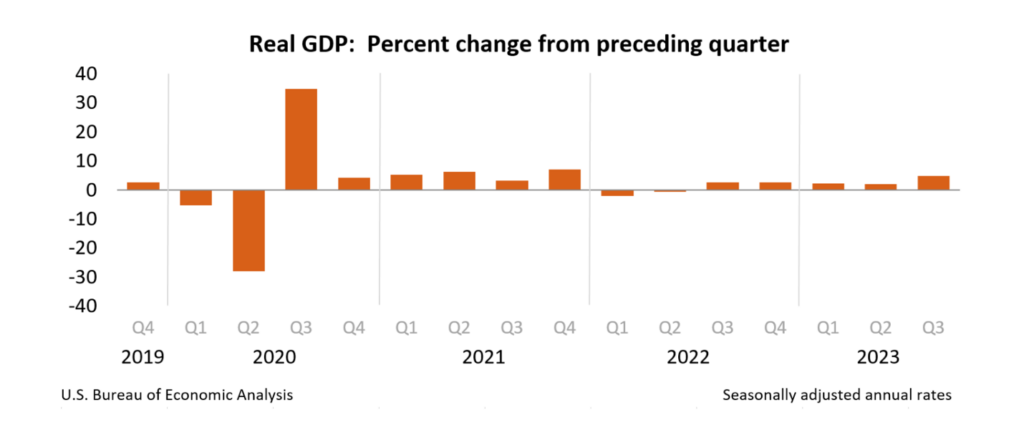

Just when you expect the United States economy to zig, it zags. Gross domestic product, the primary measure of economic output, grew at a 4.9% annualized rate from July through September, the Commerce Department reported Oct. 26. The faster-than-expected pace outperformed forecasts.

Since the Federal Reserve began aggressively raising interest rates in early 2021, nearly everyone has predicted that a recession lurks just around the next corner. Instead, third-quarter GDP posted its most robust performance since the rebound period in late 2021.

“Today’s GDP report shows the nation’s economy is again defying the odds by growing at a rate is much higher than expected,” said Selma Happ, chief economist at real estate data firm CoreLogic. “Federal interest rate policy is slowing inflation while also keeping unemployment numbers low and consumer spending strong.”

Indeed, slowing inflation has helped boost consumer purchasing power, and the job market has responded with strong showings in recent months. In September, U.S. unemployment was just 3.8%, and employers added a robust 336,000 jobs, the Labor Department reported. Year-over-year wage growth was 4.2%, a rate that outpaced inflation.

The combination of a healthy job market and cooling inflation gave consumers the confidence to spend freely on goods and services. “There’s been an enormous increase in wealth since COVID,” Yelena Shulyatyeva, senior economist for the bank BNP Paribas, told the New York Times. “People still take not just one vacation, not just two, but three and four.”

Things weren’t supposed to work out this way. In fact, the last deep downturn – the global financial crisis of 15 years ago — was followed by the Great Recession and a decade of tepid job growth and lackluster economic expansion.

The pandemic has played out very differently. The massive government stimulus during the early days of COVID-19 was designed to fend off another protracted economic calamity. With billions of people worldwide confined to their homes, the U.S. government pumped trillions into the economy. The snapback effect has been more dramatic than anyone expected.

Inflation soared, hiring surged and COVID was contained. Life returned to something like normal. But the whipsaw of an economic shutdown and a rapid reopening continue to reverberate through the economy.

In the post-pandemic world, economic reality continues to confound. “Initially, we were anticipating that a lot of that consumer strength was driven by special factors early in the summer,” Matthew Luzzetti, chief U.S. economist at Deutsche Bank, told The Wall Street Journal. “But the latest data show that there was more persistence.”

The good times are bound to end soon, many analysts predict. “Take a good look at the estimate for third quarter GDP because it could be the highest that we see for a while,” said Mark Hamrick, chief economic analyst at Bankrate.com. “With Q3 in the rearview mirror, and subject to future revisions, the focus turns to what’s in front of us. Expectations are muted for the intermediate term amid no shortage of sources of uncertainty. There’s no guarantee that recent substantial momentum can be sustained.”

Looking ahead, Federal Reserve officials are weighing whether to raise interest rates again. Many economists say growth slow through the fourth quarter as borrowing costs increase. Mortgage rates are flirting with 8%, slowing the housing market, and commercial and consumer borrowers are dealing with a higher rate environment.

“Growth this strong does not force a rate hike next week, but it means the Fed will indicate it is still contemplating higher rates,” Chris Low, chief economist at FHN Financial, said in a note, according to Bloomberg. “The Fed cannot declare tightening over with growth this strong and inflation still above target.”

Reflecting the new spate of uncertainty, 10-year Treasury yields briefly topped 5% in late October. The 10-year Treasury had been below 1% during the darkest days of the pandemic. Treasury rates are a barometer of investor sentiment and a benchmark for mortgages, and the sharp rise in rates has brought distress to commercial real estate.

Uncertainty looms in other corners, too. Wars in Ukraine and the Middle East have introduced wild cards. The chaos in the U.S. House of Representatives raises the odds of a partial government shutdown. Auto manufacturers and their workers are mired in an ongoing standoff.

For investors, the moment serves as a reminder that investing is full of risks. The ever-changing economic picture illustrates the reality of investing at the moment. Investors faced a period of intense uncertainty early in the pandemic. That was followed by a couple years of outsized returns.

As markets return to something like normalcy, the new climate underscores the wisdom of our focus on high yield investment opportunities with best-in-class operators across a variety of asset classes. The Real Asset Investor raises capital from accredited investors to acquire assets for cash flow, equity growth, tax benefits and diversification, giving investors options outside of conventional financial markets.