This summary is subject in all respects to the Company’s Investor Offering Memorandum. You should not make any investment decisions based on this summary, but only after reading the full Investor Offering Memorandum.

This summary contains privileged and confidential information and unauthorized use of this information in any manner is strictly prohibited. If you are not the intended recipient please notify the sender immediately. Without prior permission of Prestige Fund DVI, LLC (the “Company”), no person accepting this document shall release or reproduce (in whole or in part) this document, discuss any information contained herein, make representa-

tions or use such information for any purpose other than to evaluate the company’s business plans as provided herein. By accepting this document, the recipient agrees to keep confiden- tial all information contained herein or made available in connection with any further investigation. Upon request, the recipient will promptly return to the Company all materials received (including this document) without retaining copies thereof.

This summary is for informational purposes and not intended to be a general solicitation or a securities offering of any kind. Prior to making any decision to contribute capital, all investors must review and execute all private offering documents.

Potential investors and other readers are cautioned that these forward-looking statements are predictions only based on current information, assumptions and expectations that are inherently subject to risks and uncertainties that could cause future events or results to differ materially from those set forth or implied by such forward looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

These forward-look-ing statements are only made as of the date of this Business Plan and Sponsor undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

An investment in Prestige Fund D VI, LLC will be a speculative investment and subject to significant risks and therefore investors are encouraged to consult with their personal legal and tax advisors. Neither the Company nor its representatives, officers, employees, affiliates, sub-contractor or vendors provide tax, legal or investment advice. Nothing in this document is intended to be or should be construed as such advice.

1. Executive Summary

The following summary provides a concise high-level summary overview of the pertinent investment points for an investment with PFD VI, LLC (“PFD VI”) in the public exchange space (kiosks interacting with consumers in ATM and advertising monetization). We are submitting this separately from the Private Placement Memorandum to separately discuss salient elements of investment and provide specific clarity on the high performing Metro Small-Mid Retail Portfolio return. This summary document focuses on providing key points, profiles, opportunities, risks and characteristics of the space.

1.1. ATM Investment / Monetization of Asset Overview

ATM KIOSK MODEL OVERVIEW

Our core strategy is to participate in the mature and stable ATM kiosk space that has historically demonstrated strong operating margins in the unbanked and underbanked demographics, while also capturing margin with cash management and future fintech services. By accessing attractive real estate locations for ATM kiosk placements within our target demographic, we also strategically position ourselves for capitalizing on additional revenue opportunities such as providing merchant cash management services and advertising monetization of ATM assets/locations.

ATM Ownership

PFD VI owns the ATM assets and outsources the placement and management of ATMs to qualified third-party Management Companies through best-in-class negotiated management service agreements. The fund controls the tangible collateral of the ATM which qualifies for bonus depreciation. In exchange for providing the capital to purchase the ATM and place with the Management Company, the Management Company will provide the fund participation in the operating margin of the ATM (in essence a form of lease or rental) by blending thousands of ATMs into large pools to balance performance and adjust for variances based on demographic, seasonality, etc. The operating margin participation is a flat fee per blended ATM and reflects margin derived from surcharge, interchange, DCC, cash management fees, etc.

The Role of the Management Company

A management company will source lucrative merchant contracts and then provides a turnkey, plug and play, fully managed program for ATMs. All operating, maintenance, replacement, insurance, liability and general management are the responsibility of a management company. Management companies typically contract with Fiserv, Elan, CDS, etc for processing, Bancsource, Burroughs, ASI etc for maintenance, Loomis, Garda, Brinks, etc for the armored services, and US Bank and WSFS to provide the cash for ATMs.

The Management Companies we partner with are acquiring and rolling up smaller competitors and growing organically through contract RFPs. They are acquiring companies and organically winning these lucrative contracts based on various strategic and competitive advantages. Following are a few of the competitive advantages of the Management Companies we contract that present a strong value proposition to merchant retailers:

Cash Management Services

For some of our ATMs we can provide turnkey merchant cash management solutions that include armored carrier, ATM, Bank, Smart Safe, and Reporting.

New & Compliant ATMs

All ATMs in the portfolio are PCI, ADA and EMV compliant compared to over 20% of non-Financial Institutions ATMs in US that are not compliant.

Digital Media Screens

For certain ATMs we can provide retail merchants short advertising slots on digital media screens as part of package to promote retail merchant in-store products/sales.

Monetization

Sharing in monetization of ATM locations (paid a percentage of advertising revenue) through various monetization technologies.

Social Awareness

Philanthropic opportunity as seen below for locations interested in social awareness. Management companies we contract have concluded through historical comparative field results and benchmarks that when wrapping ATM in the right charitable brand they will realize over 12% increase to usage and thus can provide a percentage of surcharge to charity and remain margin neutral.

Investment Collateral Package

The investment is backed with a hard asset (ATM Kiosk) that has long usable life cycles. Additionally, we have negotiated assignment of the merchant location agreements (where ATM is placed) in the event of a default by the Management Company. The location agreements have substantial market valuation and could be flipped (either sold or placed to operate) quickly to another Management Company thereby mitigating risk given they trade at high multiples when paired with a merchant location agreement.

Sponsor Bank/Risk Management

Our Management Companies are registered IADs and are therefore required to have a Sponsor Bank. The Sponsor Bank role is a third-party audit to ensure compliance, viability, and operational excellence of our Management Companies as they perform audits on finance, operations, process/systems, etc. This industry is highly regulated as the Management Company utilizes the same financial networks/processors (Fiserv, CDS, etc.) as a bank and, therefore, is subject to annual and biannual audits by a Sponsor Bank. While the details of the audit the Sponsor Bank performs on the Management Company are naturally proprietary to the Sponsor Bank, they do provide the Fund an annual letter of good standing from their audits.

ATM Deployment Cycles

Deployment cycles generally take 60-75 days until ATMs are installed and operational at retail merchant location or taken over and converted into operational and management systems in the event of acquisition. The process is as follows: Capital is wired to the Management Company each month on a defined schedule. ATMs are then procured and shipped to a warehouse by the Management Company. ATMs are then staged (upgraded to bank standard vaults, wraps installed, programmed for user options, implemented with various components and technology, etc.). ATMs are then shipped to a geo- specific warehouse where the installation company will pick them up to install.

ATM KIOSK FUNCTION OVERVIEW

The traditional core ATM kiosk business of distributing cash is resilient and strong, given our focus on the unbanked and underbanked demographic as they continue to have a consistent demand for cash. The underbanked typically have a bank account they only use for payroll processing purposes; however, they withdraw all of their cash through ATMs as it provides them safe and convenient access to cash. In the case of both the underbanked and unbanked, many are receiving government assistance funds and ATMs provide a fast, convenient, and secure method of accessing those funds. Beyond the underbanked and unbanked communities, we are still experiencing the average consumer requiring cash on a consistent basis for smaller purchases, tips, many other daily services, as well as the convenience of accessing cash through thousands of easily accessible ATMs across the country.

Increasingly banks are desiring to brand with us as they are starting to see ATM kiosks as a mini bank branch. Every bank is seeing branch traffic decreasing over the last decade thus increasingly embracing the ATM kiosk model. Accordingly, many banks now view an ATM kiosk as a bank vault on the street that can distribute and provide quick/easy access to cash for their customers.

CORE DEMOGRAPHICS

In summary, the core demographics using our ATMs would generally be characterized as:

- Underbanked or unbanked demographic*

- Lack credit and thus credit card access

- Has credit capacity, however distrusts credit card given security and hack breaches evidenced by an uptick in usage with security breaches at larger retailers in the past few years

- Use ATMs for EBT debit cards**

- Use Prepaid debit cards as they fall under the underbanked or unbanked demographic

- Use ATMs for transferring funds or other bank functions in lieu of doing online given security concerns

*Approximately 10 million households are unbanked and use ATMs with prepaid debit cards, etc. and approximately 26 million households are underbanked, which means they have a bank account; however primarily use AFS (alternative financial services) such as prepaid debit cards

**Electronic Benefit Transfer – government system for issuing welfare payments electronically, by way of debit card which recipients use to make purchases

INNOVATION

While the core operating model and margin of an ATM kiosk is strong, we are seeing the ATM kiosk space go through some innovation and our Management Companies are moving into increased cash management and financial services. In strategic locations, our fund is starting to deploy ATM kiosks within our blended pools that perform services through the ATM kiosk that include technology such as cash recyclers and, therefore, further enhance the "mini bank branch in a box" value proposition. In short, an ATM kiosk with cash recycler technology will accept cash deposits from the merchant retail operations, and then recycle that cash to be used for cash withdrawals. This provides a variety of enhanced and powerful value propositions to the merchant, operator, and consumer, of which we have outlined below:

MERCHANT VALUE PROPOSITION

- Merchant deposits their cash from their retail operations into ATM kiosks, which reduces or eliminates armored pickup, doing bank runs, or paying for safe smart devices

- Merchant gains instant credit access and is provided a form of provisional credit facility so they can pull cash when they need it from the ATM kiosks on demand or, in some cases, have money wired into their account

- Merchant removes the need to count and reconcile cash manually, and they also limit the risk of in-store cash by depositing into ATM kiosks

- Merchant pays our Management Company a fee to utilize ATM kiosk for deposits, which is a lower cost and is more convenient than having armored do pickups

- Merchant uses ATM kiosks for start of shift register funds, deposit end of shift funds, deposit intra-day sweeps, and split bills and grab change when needed for register

- Merchant is provided reports to track and verify store activity, as well as improve register and employee accountability with individual IDs and PINs, all which reduce risk

- In summary, the Merchant receives a turnkey cash management solution that includes armored carrier, ATM, Bank, Smart Safe, and Management Reporting, all which are generally disparate services for merchants with hefty monthly fees (specifically armored pickup and Smart Safe vault services) along with a significant reduction in labor cost

CONSUMER VALUE PROPOSITION

- Provide deposit services

- Provide bill pay services

- Provide prepaid and mobile top-up services

- Provide financial services to the unbanked and underbanked

- Provide money transfer services, which continue to average 14-18M per month in the United States

- In many cases, customers will be able to make cash

deposits into their bank accounts

MANAGEMENT COMPANY VALUE PROPOSITION

- Operator significantly reduces or eliminates Armored Costs (Brinks or Loomis delivering cash) by taking deposits from Merchant. (Armored is one of the largest COGs to operate an ATM kiosk)

- Operator significantly reduces or eliminates Cost of Cash by taking deposits from Merchant (Cost of the cash that resides in ATM kiosks is another significant COG in the operation of an ATM kiosk)

- Operator is experiencing an increase of 2-6% in volume by providing deposit and money transfer services to the consumer

- Operator can also allow nearby small retail Merchants from where they have an ATM kiosk located, to access the same merchant deposit services acting as a mini bank branch or night depository for those nearby Merchants without this type of ATM kiosk

EMERGING TECHNOLOGY RISK OVERVIEW

There is inherent technology obsolesce risk with every investment, however, we have characterized the summary points below as to why the risk profile is quite low with ATMs, regardless of the legacy aspect of an ATM:

- Ethnic groups in large Cities use as banking system and will continue to do so

- Majority of demographic using ATMs will always use cash, regardless of other options

- Monetary (cash) system is growing annually regardless of new mobile technologies, etc.

- Many analysts project an increase to ATM kiosks (mini bank branch in a box) given increase in banks moving to distribute cash through ATM kiosks vs the bank branch, combined with the economic system we are currently under, will likely continue to grow the demographic that is heavy cash usersne security breaches

New Technologies Risk Assessment:

- New mobile and other payment technologies (apple pay, etc.) are primary risks for credit card companies, not ATM and cash users

- The current credit distressed demographic, who are heavy ATM users, will have the same credit challenges with any new mobile or alternative technologies that they had with credit card access.

- Adoption of any new disruptive technology typically takes 5-7 years to hit stride. Even risks such as digital currency would take many years to implement from a regulatory perspective and our demographic would resist such digital technologies as they are slow to adopt any new technologies

ATM MONETIZATION OVERVIEW

While we are engaged in many different forms of ATM monetization initiatives, below provides some context in a few areas we are/will be monetizing the ATM beyond cash and merchant cash management services:

Surcharge Income

The ATM core investment model generates surcharge revenue and provides a strong predictable return

Interchange

this is the fee collected from financial networks (consumer does not get the charge) for every transaction including balance inquiries

DCC

the fee charged for digital currency conversion when a tourist or traveling international business person uses an ATM to pull USD converting from their home country currency.

Bank Branding

regional or national banks paying $50-$200/month for branding in strategic locations

1.2. Financial Summary Overview

Metro Small-Mid Retail Portfolio

Metro Small-Mid Retail Portfolio

Overview of Portfolio: PFD VI is comprised of small-mid retail primarily in larger

metro areas. The portfolio is largely represented by small chain c-stores, small

retail stores, bodegas, and sundry shops (deli/grocery stores), travel plazas and

other high traffic locations.

Almost exclusively, these ATMs are replacing existing ATMs, and the

Management Company has performed 24+ month of diligence on transactional

data. This portfolio is blended which means that Management Company has aggregated all locations to normalize the return for investors thereby adjusting for performance variances of ATMs (location, geo seasonality, etc.) within the portfolio. This will allow all investors in the Fund to have equitable returns.

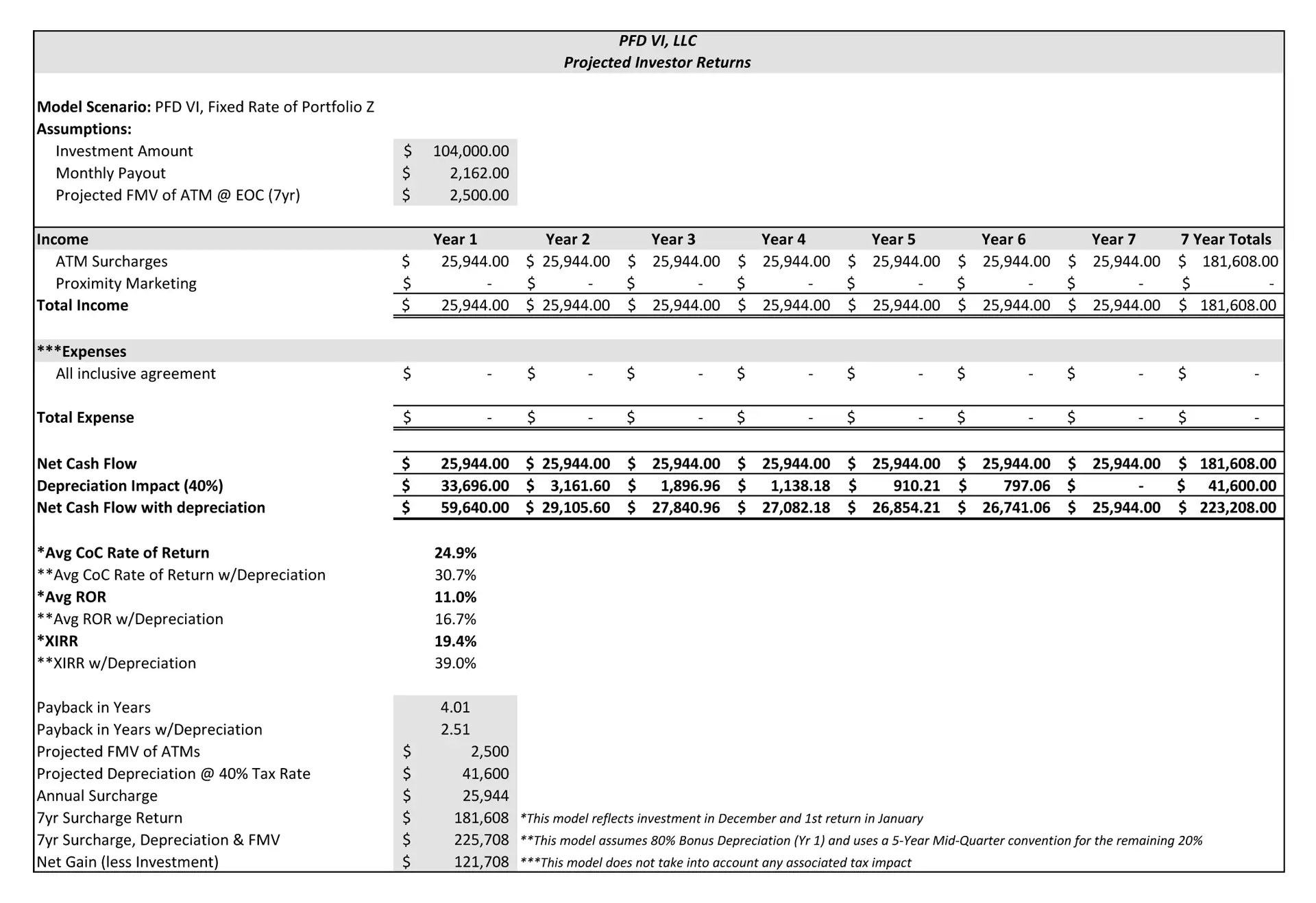

Financial Terms (Please see the next page for more detailed financial projections)

100% Depreciation over the life of the investment, with 80% Bonus Deprecation coming in Year 1.

Projected Cash Flows and Depreciation Benefits for every

$104,000 Invested:

- Monthly – $2,162

Annual – $25,944

Term – $181,608 (Not including depreciation impact) - Depreciation Benefit – $41,600 (Projected at

40% tax rate)

- Total Projected Returns, Including Depreciation -

$225,708 (plus any residual value of ATMs)

- For illustrative purposes, attached under appendices you will find financial summaries which reflects the economics for Metro Small-Mid Retail Portfolio

- Appendix A Projections at $104,000 invested reflects 80% Bonus Depreciation in Year 1

1.3. Appendices

Appendix A – PFD VI Projected Return Summary

IMPORTANT: The projections or other information generated by the cash flow model above regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results.

THIS DOCUMENT IS FOR INFORMATIONAL PURPOSES ONLY

This document does not convey an offer of any type and is not intended to be, and should not be construed as, an offer to sell, or the solicitation of an offer to buy, any interest in any entity or other investment vehicle. If such an investment opportunity should become available, a confidential private offering memorandum outlining such investment opportunity would be provided to you, and the information in this document would be qualified in its entirety by reference to all of the information, including without limitation the risk factors, in the confidential private offering memorandum.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Executive Summary contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements are therefore entitled to the protection of the safe harbor provisions of these laws. These statements may be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “budget,” “contemplate,” “continue,” “could,” “envision,” “estimate,” “expect,” “forecast,” “guidance,” “indicate,” “intend,” “may,” “might,” “outlook,” “plan,” “possibly,” “potential,” “predict,” “probably,” pro-forma,” “project,” “seek,” “should,” “target,” “will,” “would,” “will be,” “will continue” or the negative of or other variation on these words or comparable terminology. Management cautions that the forward-looking statements contained in this Executive Summary are not guarantees of future performance, and we cannot assure that these statements will be realized or the forward-looking events and circumstances will occur. The risks, uncertainties and assumptions that could cause actual results to differ materially from those anticipated or implied in our forward-looking statements include, but will not limited to, those set forth in the “Risk Factors” section of a PPM when distributed. The forward-looking statements include, but are not limited to, statements discussing the following matters:

- Our status as a new company with no prior operations;

- Our ability to manage the investment successfully with a view towards long-term appreciation;

- The Investment Fund’s anticipated cash needs;

- Changes in economic conditions generally and the financial markets specifically; and

- The other risks described in the “Risk Factors” section of the PPM when distributed.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. Nevertheless, the Investment Fund’s business involves risks and uncertainties (many of which are beyond the Investment Fund's control) that may affect its actual operating and financial performance and cause its performance to differ materially from the performance anticipated in the forward-looking statements. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this Executive Summary or otherwise make public statements updating our forward-looking statements whether as a result of new information or future events or developments or to conform those statements to actual results.

Frequently Asked Questions

PFD VI

There is liability insurance. Although we have never had any claims or liability issues, we do have several Million Dollars of liability insurance protecting investors. It’s also important to note that investors are limited partners meaning that their losses are limited to their initial investment.

In airports, high foot traffic Deli’s in Manhattan and multiple other cities, food courts, grocery store chains etc..

$52,000

Approximately 99% of the time we are going into a location where there is an existing ATM machine and taking over that location. We can see the historical data and tell exactly how that location has been performing over the last several years which greatly reduces the risk. Because we focus on providing premium service to our clients and to ensure that all of our ATMs meet full compliance, we replace most ATMs within the locations we acquire with brand new ATMs that we provision with our proprietary software.

Most investors own ATM machines in their personal name because the ATMs are held inside an entity already and the management company carries a big Insurance policy on them for liability. You have a few firewalls between you and the asset. We have more than $450 Million dollars worth of ATMs placed and in service and while there have been no liability issues to date we certainly do not discourage holding your assets in an entity.

At the end of the 7 year period the contract is over and your monthly distributions will stop. At that point the management company will sell the ATM machines at fair market value and you will receive your pro rata share of those proceeds. To be conservative, we do not believe there will be much value left in your ATMs at that time due to wear and tear and we therefore assumed that each machine would be worth $500 in liquidation value at the end of the 7 year period.

ATM orders get turned in around the 15th of each month, from that day forward we have 75 days to order your machines and place them in service. The first full month after that is when your machines are producing and building cashflow, you will then receive an email on the 25th day of the following month with your investor statement and notification that a deposit has been made into your account via ACH. If the 25th is on a weekend this process will be delayed until the following Monday. It’s therefore best to assume that there will be an approximate 4 month delay between when you invest and when you will receive your first distribution.

The management company will go in, remove the machine and put it in a new location at no charge to the investor and there will be no lapse or reduction in the distribution amount. Remember you are in a blended pool with more than 1000 other ATMs and you are receiving a blended return.

Our management company commits to each investor that each unit ($104,000 investment) is projected to receive $2,162 per month. Investors get paid on a blended performance of the entire fund and in the rare occasion that the fund performance is lagging, management will share their portion of the revenue to bring the distribution up to the proforma amount. In the event that the fund over performs, management retains the revenue above the fixed investor return.

No, all expenses are covered by our management team.

Since 2012.

We have paid distributions in full and on time in all funds since we got involved in this business back in 2012.